The industrial real estate market is bustling, but supply falls short of demand

Industrial real estate continues to attract investors due to high demand and the growth of the global financial and economic markets. Despite lockdown orders and travel restrictions, the China+1 model is becoming a trend as manufacturers seek to minimize risks and diversify their supply chains. John Campbell, Director of Industrial Services at Savills, notes that multinational enterprises will face difficulties in finding locations near major cities like Hanoi and Ho Chi Minh City due to limited supply, high prices, and high occupancy rates in key industrial zones.

The occupancy rate has been continuously increasing since 2018 in industrial zones, highlighting the gap between supply and demand, and the urgent need to expand the supply in key industrial cities. In 2020, the occupancy rate in Ho Chi Minh City reached 88%, almost full capacity in Binh Duong with 99%, Dong Nai with 94%, Long An with 84%, and Ba Ria - Vung Tau with 79%. In the North, the average occupancy rate is up to 90% in Hanoi, 89% in Hung Yen, 95% in Bac Ninh, and 73% in Hai Phong.

Limited supply has led to escalating rental prices, becoming a major concern for industries with low value-added such as textiles and furniture. Currently, average rents remain reasonable for high-value industries like high technology, supporting industries, and automotive manufacturing.

There has been a sudden surge in demand for industrial land for rent, ready-built factories, and warehouses, leading to price escalations in industrial zones near major cities. In Northern Vietnam, in 2020, prices in Hanoi increased by 13.1% compared to the same period, reaching $129/m2, Bac Giang increased by 9.2% to $95/m2, Hai Duong increased by 15.1% to $76/m2. In the South, Ho Chi Minh City witnessed rents around $147/m2 while in industrial zones in Binh Duong, prices reached $107/m2, and Long An increased by 7.8% to $123/m2. The general increase in industrial real estate prices is partly due to upgraded infrastructure with new roads, ports, and airports being invested in.

According to the Department of Economic Zones Management, infrastructure of industrial zones will continue to be upgraded. Policies and management mechanisms are continuously improved to achieve higher efficiency. Many industrial zones are under construction to help reduce prices in the future.

Tan Thuan Export Processing Zone - Industrial real estate in the heart, stable prices

In 2021, Ho Chi Minh City ranked third nationwide in attracting FDI with 633 newly licensed projects, indicating a vibrant commercial and industrial real estate market with escalating prices in the coming years.

Standing alongside the challenges of businesses, Tan Thuan EPZ commits to maintaining stable prices for a long time, which is why many of our partners have become strategic partners for many years. Currently, Tan Thuan offers various types of real estate for rent to meet the needs of investors looking for factories, offices in industrial zones right in the center of Ho Chi Minh City at reasonable and stable costs for a long time.

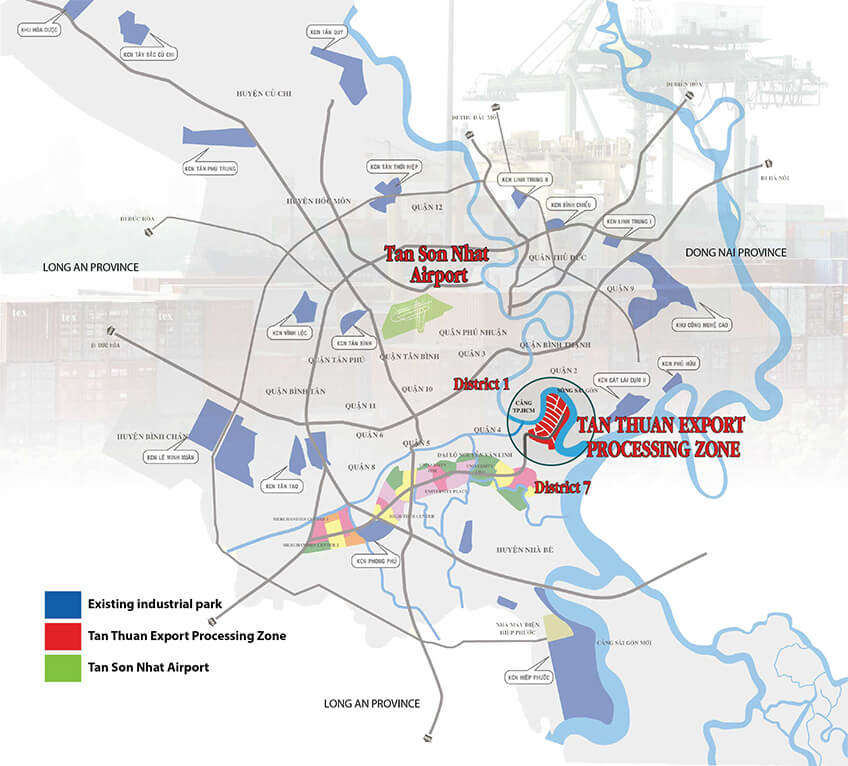

Tan Thuan EPZ strategic ocation

Tan Thuan's advantages include:

- Advanced and complete infrastructure system with fire stations, hospitals, Tan Thuan EVN, wastewater treatment system, etc.

- Prime location in District 7, near seaports, airports in the city, 4km to District 1 center.

- Stable prices for a long time.

- Sustainable service quality maintained for over 30 years, Tan Thuan always welcomes investors from all over the world.

- Diverse service products suitable for investors' needs.

Contact us now for specific advice!